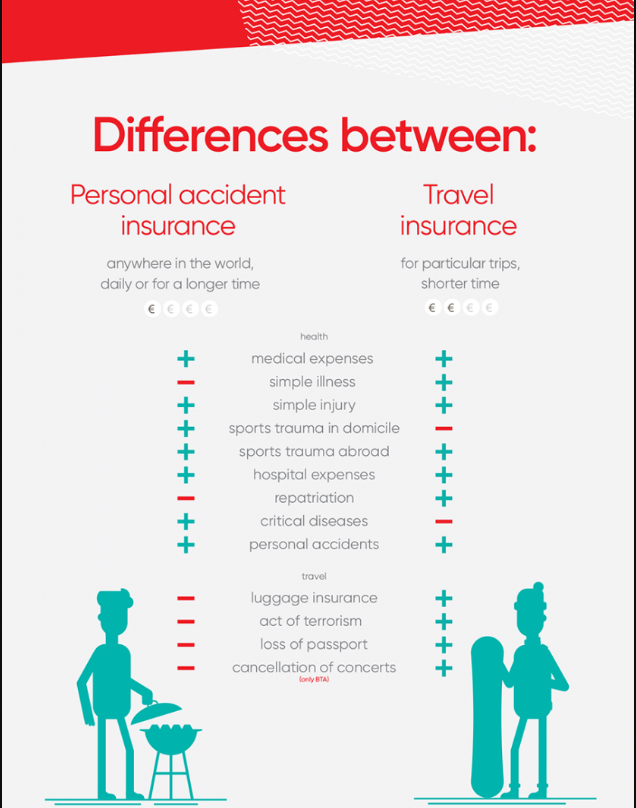

Travel Insurance vs Personal Accident: Travel insurance safeguards your trip itself (cancellations, medical emergencies abroad), while personal accident insurance offers wider protection for accidents anytime, anywhere (death benefit, disability). Choose travel insurance for trip hiccups, personal accident insurance for overall accident coverage.

When it comes to protecting yourself and your finances, insurance is a crucial consideration. However, with so many different types of insurance available, it can be difficult to determine which one is the best fit for your needs. Travel insurance and personal accident insurance are two types of insurance policies that provide coverage for different aspects of your well-being while you are away from home. While both offer protection in the event of an accident or unexpected incident, they serve different purposes and cover different risks. In this blog post, we will explore the differences between travel insurance and personal accident insurance to help you make an informed decision when choosing the right insurance coverage for your needs.

What is Travel Insurance?

Travel insurance is an insurance policy designed to protect travelers against unexpected events that may occur before or during a trip. It covers a range of situations such as trip cancellations, lost luggage, medical emergencies, and travel delays. It provides financial protection and assistance to travelers when unexpected events disrupt their travel plans. Travel insurance is obtained for a specific travel period, ranging from one day up to 365 days. It’s designed to protect you from a range of unexpected events specifically related to your trip, including:

- Medical emergencies: Covers medical bills if you fall sick or get injured abroad.

- Trip cancellation or interruption: Reimburses you for prepaid travel costs if you have to cancel due to unexpected circumstances (such as illness or natural disasters).

- Lost luggage or travel delays: Compensates you for lost or delayed luggage, or covers additional expenses due to travel delays.

- Other trip disruptions: May include coverage for missed connections, emergency evacuation, and even civil unrest at your destination.

Travel insurance does not cover critical diseases that may occur during your trip. It also excludes expenses related to repatriation, terrorism risks, luggage return, and passport renewal.

What is Personal Accident Insurance?

Personal accident insurance provides financial protection in the event of accidental injury, disability, or death. Personal accident insurance offers coverage for medical expenses, disability benefits, and accidental death benefits resulting from covered accidents. You can choose from various options, such as 24-hour coverage, during working hours, commuting to and from work, or during specific activities. It is designed to provide financial support to individuals and their families in case of unforeseen accidents. Personal accident insurance typically covers lost income, medical expenses, and funeral expenses in the event of an accident. It includes the following:

- Accidental Death Benefit: Personal accident insurance provides a lump sum payment to the insured’s beneficiaries in the event of the insured’s death due to a covered accident.

- Disability Benefits: Personal accident insurance offers benefits for total or partial disability resulting from a covered accident, providing financial support to the insured during the recovery period.

- Medical Expense Coverage: Personal accident insurance covers medical expenses incurred as a result of an accidental injury, including hospitalization, surgery, and rehabilitation costs.

Personal accident insurance can cover you in specific regions (e.g., Latvia, Europe, or worldwide).

Travel Insurance vs Personal Accident

| Feature | Travel Insurance | Personal Accident Insurance |

|---|---|---|

| Coverage | Trip cancellation, medical emergencies abroad, lost luggage, travel delays. | Death benefit, disability benefits, medical expenses (policy dependent). |

| Focus | Protects specifically for your trip. | Provides broader coverage for accidents. |

| Expenses Covered | Does not cover repatriation expenses, terrorism risks, luggage, or passport return/renewal expenses. | Typically covers expenses incurred due to injuries requiring medical assistance. |

| Validity | Only valid for your designated trip duration. | Ongoing coverage, not tied to travel. |

| Best for | Frequent travelers, those with specific trip concerns. | People seeking general accident protection. |

| Benefits | Trip cancellation reimbursement, emergency medical coverage, travel assistance services. | Accidental death benefit, disability benefits, medical expense coverage. |

Which one do you need?

The type of insurance you need will depend on your specific circumstances and the risks you face. If you are planning a trip, travel insurance is a good option to consider as it can provide coverage for a variety of unexpected events that may occur while you are away from home. However, if you are looking for coverage for accidents that may occur regardless of where you are, personal accident insurance may be a better fit.

It’s also worth noting that some credit cards and health insurance plans offer some form of travel insurance, so it’s always a good idea to check your existing coverage before purchasing a separate travel insurance policy.

Why you might need both?

You might need both travel insurance and personal accident insurance to ensure comprehensive coverage for different scenarios. Travel insurance can protect you during trips against various risks like trip cancellations, medical emergencies, and lost luggage. On the other hand, personal accident insurance provides coverage for accidental injuries, disabilities, and death that may occur in your daily life, not just during travel. Having both types of insurance can offer you a well-rounded protection plan, addressing different aspects of your safety and financial security both while traveling and in your everyday activities.

Conclusion

In short, travel insurance focuses on travel-related risks. While personal accident insurance provides coverage for accidental injuries regardless of whether you’re traveling or not. Consider your needs and circumstances when choosing the right insurance for you!