Digital Insurance vs Traditional Insurance: Digital insurance offers a fast, convenient, and potentially cheaper way to buy insurance entirely online, but may lack human interaction and established brands. Traditional insurance provides personalized service from agents and a wider range of products, but can be time-consuming and potentially more expensive.

In today’s rapidly evolving digital landscape, the insurance industry is undergoing a significant transformation with the rise of digital insurance solutions. Traditional insurance practices are being challenged by innovative digital technologies that offer enhanced convenience, efficiency, and customer experience. Let’s explore the key differences between Digital Insurance and Traditional Insurance to understand their impact on the insurance sector.

What is Digital Insurance?

Digital insurance, also known as insurtech, refers to insurance services that leverage technology and digital platforms for various processes. Following are some key aspects of digital insurance:

- Online Presence: Digital insurance companies operate primarily online, allowing customers to purchase policies, manage claims, and access information through websites or mobile apps.

- Automated Processes: Insurtech companies use automation, artificial intelligence (AI), and data analytics to streamline processes such as underwriting, claims processing, and customer service.

- Customization: Digital insurers offer personalized policies based on individual needs, using data-driven insights to tailor coverage.

- Speed and Convenience: Customers can buy policies instantly, receive policy documents via email, and file claims online without paperwork.

- Innovative Products: Digital insurers often introduce innovative products, such as pay-as-you-go coverage, microinsurance, and usage-based policies.

What is Traditional Insurance?

Traditional insurance has been the norm for decades and involves established insurance companies. Following are the key features of traditional insurance:

- Agent or Broker Involvement: Traditional insurers rely on agents or brokers to sell policies, explain coverage options, and assist with claims.

- Physical Offices: These insurers have physical offices where customers can visit for inquiries, policy purchases, and claims.

- Manual Processes: Underwriting, claims assessment, and policy issuance involve manual paperwork and processes.

- Standardized Policies: Traditional insurers offer standardized policies with fixed terms and conditions.

- Risk Pooling: Traditional insurance pools risks across a large customer base to spread the financial burden.

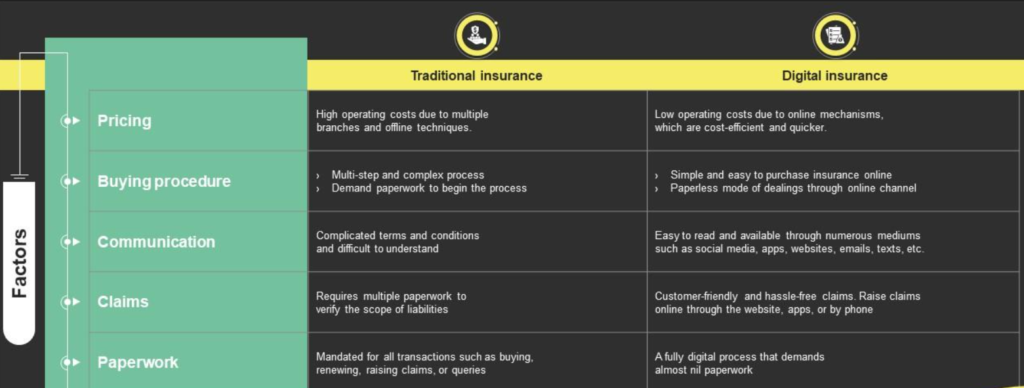

Digital Insurance vs Traditional Insurance

| Aspect | Digital Insurance | Traditional Insurance |

|---|---|---|

| Customer Interaction | Online platforms, self-service | Direct contact with agents, face-to-face interactions |

| Process | Efficiency Fast, automated processes, instant policy issuance | Slower due to manual processes and paperwork |

| Cost | Generally lower due to reduced overhead | Higher due to agent commissions and administrative costs |

| Accessibility | Available 24/7, accessible anywhere with an internet connection | Limited to office hours and geographical reach |

| Personalization | Data-driven recommendations using algorithms | Personalized advice from experienced agents |

| Convenience | High, with easy online management and quick claims processing | Lower, often requiring in-person visits and lengthy procedures |

| Transparency | Clear, accessible information on platforms | Information may vary depending on agent |

| Offerings | May offer fewer policy options | Usually offers a wide range of policies |

| Trust and Reliability | Newer companies, may lack long-term track record | Established brands with proven track records |

| Technical Issues | Potential for system failures or cyber-attacks | Less reliance on technology, fewer technical vulnerabilities |

| Customer Support | Primarily online, chatbots, and email support | Direct, personalized support from agents |

How to choose the right one?

Consider the following points while choosing the insurance:

- Assess Your Preferences: Consider if you prefer online convenience and customization (Digital Insurance) or personal interactions and established practices (Traditional Insurance).

- Evaluate Technology Comfort: Determine your comfort with technology for managing insurance needs.

- Compare Services: Review policy management, claims processing, and customer support offerings of both types.

- Consider Accessibility: Evaluate the accessibility of services, such as online platforms or agent interactions.

- Review Costs: Compare premiums, deductibles, and coverage options to find a suitable balance.

- Seek Recommendations: Gather insights from peers, reviews, and experts to make an informed decision based on your needs.

The Future of Insurance

As the insurance industry continues to embrace digital transformation, a hybrid approach combining the strengths of Digital Insurance and Traditional Insurance may emerge. Insurers are increasingly adopting digital tools and technologies to enhance operational efficiency, customer engagement, and risk management. While Digital Insurance offers speed, convenience, and personalization, Traditional Insurance provides stability, trust, and human touch. Finding the right balance between digital innovation and traditional values will be crucial for insurers to thrive in the evolving insurance landscape.

Choosing Your Insurance Path

The best choice depends on your priorities. If you value convenience, affordability, and a user-friendly experience, digital insurance might be the way to go. But if you prefer personalized service, a wider range of options, and the security of established brands, traditional insurance might be a better fit.

Conclusion

The shift towards Digital Insurance signifies a new era of insurance characterized by technology-driven solutions, customer-centricity, and also agility. While Traditional Insurance remains relevant with its established practices and human touch, embracing digital advancements is essential for insurers to stay competitive, meet evolving customer expectations, and navigate the future of insurance successfully.