Umbrella Insurance vs Renters Insurance: Umbrella Insurance offers extended liability coverage beyond primary policies, protecting assets from lawsuits whereas, Renters Insurance covers personal belongings and provides liability coverage for rented living spaces, essential for tenants to safeguard possessions.

Living in a world full of ‘what ifs’ can be stressful, especially when it comes to your finances. What if you accidentally cause damage to someone else’s property? Or, what if you’re sued for something you didn’t even realize you were liable for? These are the exact scenarios where Umbrella Insurance and Renters Insurance come into play, but how do you know which one you need? While both serve to provide financial protection, they cater to different needs and offer distinct coverage options. Let’s find the differences of Umbrella Insurance and Renters Insurance to help you make an informed decision about which type of coverage suits your requirements best.

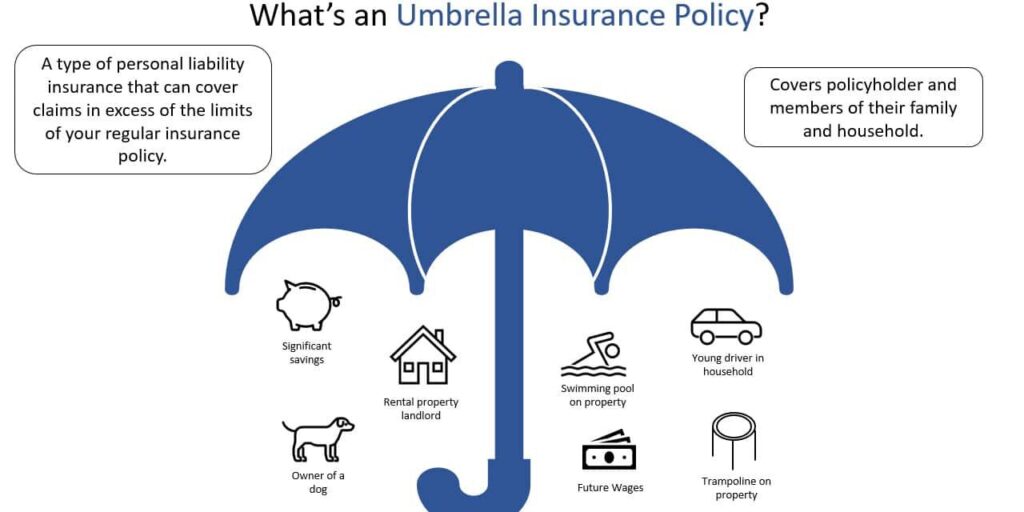

Umbrella Insurance

Umbrella Insurance acts as an additional layer of liability coverage that goes beyond the limits of your primary insurance policies, such as auto or homeowners insurance. It offers protection against lawsuits and claims that exceed the limits of your standard policies. Umbrella Insurance is designed to safeguard your assets, including savings, investments, and future earnings, in the event of a costly liability claim or lawsuit. This type of insurance provides broader coverage and higher liability limits, making it a valuable supplement to your existing insurance portfolio.

What it covers?

- Liability: Extends your liability coverage for things like car accidents, personal injury, and property damage lawsuits.

- Defense Costs: Covers legal fees and other costs associated with defending yourself in a lawsuit.

- Excess Coverage: Provides coverage for situations where your existing policies have reached their limits.

Renters Insurance

Renters Insurance is a policy specifically tailored for individuals who rent their living space, whether it’s an apartment, condo, or house. This type of insurance protects your personal belongings, such as furniture, electronics, clothing, and valuables, in case of theft, fire, or other covered perils. Additionally, Renters Insurance includes liability coverage, which can help cover legal expenses if someone is injured on your rented property. Renters Insurance is essential for tenants to safeguard their possessions and mitigate financial risks associated with unforeseen events.

What it covers?

- Personal Property: Your belongings are covered for loss or damage due to covered perils.

- Liability: Covers legal expenses and damages if someone sues you for an injury or property damage that occurred in your apartment.

- Additional Living Expenses: Helps you pay for temporary housing and other necessary expenses if your apartment becomes uninhabitable following a covered event.

Umbrella Insurance vs Renters Insurance

| Aspect | Umbrella Insurance | Renters Insurance |

|---|---|---|

| Coverage Purpose | Provides additional liability coverage beyond standard policies. | Covers personal property and liability within the rental unit. |

| Liability Coverage | Starts at $1 million. | Typically offers around $100,000 in liability protection. |

| Property Damage | Doesn’t cover physical property damage. | Doesn’t cover damage to other renters’ property. |

| Use Case | Broader liability protection for various scenarios. | Protects your personal belongings and provides liability coverage. |

When you need Umbrella Insurance?

You may need Umbrella Insurance when you want additional liability coverage beyond the limits of your primary insurance policies, such as auto or homeowners insurance. It can be beneficial if you have significant assets to protect or if you are at risk of facing high-cost liability claims or lawsuits.

When you need Renters Insurance?

You may need Renters Insurance when you are renting a living space, such as an apartment, condo, or house. To protect your personal belongings from risks like theft, fire, or other covered perils. Renters Insurance also provides liability coverage in case someone is injured on your rented property, making it essential for tenants to safeguard their possessions and mitigate financial risks.

Do you need both?

Whether you need both Umbrella Insurance and Renters Insurance depends on your individual circumstances and level of risk exposure. If you rent a living space and want to protect your personal belongings while also having additional liability coverage beyond your primary policies, having both types of insurance could provide comprehensive protection for your assets and liabilities. Assess your needs, assets, and risk factors to determine if having both Umbrella Insurance and Renters Insurance is necessary for your financial security.

Conclusion

Both Umbrella Insurance and Renters Insurance serve distinct purposes in safeguarding your financial well-being. While Umbrella Insurance offers broader liability protection, Renters Insurance focuses on protecting personal belongings and liability in rented spaces. Assess your individual needs, assets, and risk exposure to determine which type of insurance aligns best with your requirements. By understanding the differences of Umbrella Insurance vs Renters Insurance, you can make decision to secure your financial future effectively.