Self-Funded vs Fully Insured Erisa: An employee retirement income security act (ERISA) plan is a qualified retirement plan that is designed to provide benefits to employees or their beneficiaries. ERISA plans can be self-funded or fully insured. The type of plan that is right for you depends on a number of factors, including the size of your business, the number of employees, and your risk tolerance.

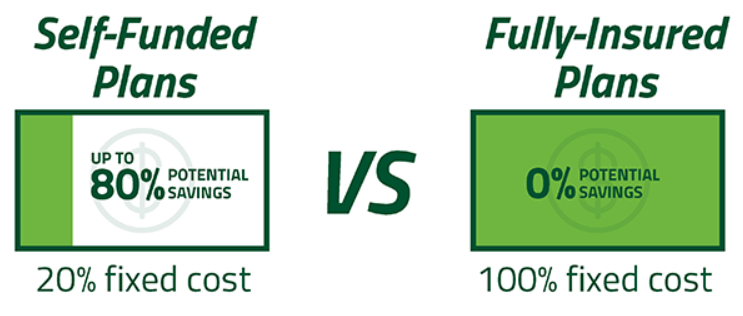

Self-funding involves the employer assuming direct financial responsibility for healthcare expenses and claims, while fully insuring shifts the risk to an insurance carrier. Both options come with distinct advantages and disadvantages, making it imperative for employers to carefully weigh the implications before selecting the optimal approach that aligns with their strategic goals and financial capabilities.

| Aspect | Fully-Insured Plans | Self-Funded Plans |

|---|---|---|

| Cost Implications and Savings Potential | Fixed premiums that include the insurer’s overhead and profit margin, leading to potentially higher overall costs. | Potential for cost savings by avoiding insurer’s overhead and profit margin; costs vary based on actual claims. |

| Risk Management and Liability | The insurance company assumes all risks for claim costs, offering predictable expenses for the employer. | Employer assumes the risk for paying out claims, which can lead to significant financial exposure in the case of high claims. Employers often purchase stop-loss insurance to mitigate this risk. |

| Flexibility and Customization | Limited flexibility with predetermined plan options provided by insurance carriers. | High flexibility to tailor health benefits to specific needs of the workforce, offering customized deductibles, copays, and covered services. |

What is an ERISA Plan?

An ERISA plan refers to an employee benefit plan governed by the Employee Retirement Income Security Act (ERISA) in the United States. ERISA sets standards for retirement, health, and other welfare benefit plans offered by employers. These plans serve various purposes, including providing retirement income, health coverage, disability benefits, and life insurance. ERISA imposes fiduciary duties on employers and administrators, requiring them to act in participants’ best interests. Additionally, ERISA mandates reporting and disclosure requirements to ensure transparency. Notably, ERISA preempts state laws for self-funded plans but not fully insured plans.

Self-Funded vs Fully Insured Erisa

Self-Funded ERISA Plans

- Definition: Self-funded (or self-insured) ERISA plans are funded directly by the employer. Instead of purchasing insurance, the employer pays benefits from its general assets or a dedicated trust fund.

- Risk: Employers assume the financial risk for claims. They pay for medical expenses as they arise.

- Flexibility: Self-funded plans offer more flexibility in plan design, allowing customization to meet specific employee needs.

- Preemption: Self-funded plans fall under ERISA preemption, which means they are subject to federal law and not state regulations.

- Cost Control: Employers can manage costs by tailoring benefits and controlling expenses.

Fully Insured ERISA Plans

- Definition: In fully insured ERISA plans, employers purchase insurance coverage through providers like Blue Cross Blue Shield. The insurance company pays claims.

- Risk: The insurer bears the claims risk, not the employer. Premiums are paid to the insurer.

- Stability: Fully insured plans offer stability and predictability in costs.

- State Law: Unlike self-funded plans, fully insured plans are subject to state laws and regulations.

- Less Flexibility: Employers have less flexibility in customizing plan features.

Choosing the Right Fit: Consider These Factors

The ideal choice between self-funded and fully insured ERISA plans depends on your company’s specific needs. Following are some key considerations:

- Company Size: Larger companies with a healthy employee population might benefit from the potential cost savings of a self-funded plan.

- Budget: Self-funded plans require upfront capital reserves to cover potential claims fluctuations.

- Risk Tolerance: Are you comfortable with the financial risk associated with covering high medical claims?

- Administrative Resources: Do you have the staff and expertise to manage a self-funded plan?

Conclusion: Self-Funded vs Fully Insured Erisa

Self-funded and fully insured ERISA plans both have their own advantages and disadvantages. The type of plan that is right for you depends on a number of factors, including the size of your business, the number of employees, and your risk tolerance. If you are not sure which type of plan is right for you, you should consult with an experienced employee benefits advisor.