When it comes to loans, credit cards, or any form of borrowing, understanding the actual cost is crucial. The Annual Percentage Rate (APR) is often the first number we encounter. Enter the Effective Interest Rate (also known as the Effective Annual Rate or Annual Equivalent Rate), which considers the impact of compounding and provides a more accurate measure of what you’ll pay over a year. This blog explores the importance of understanding these rates – the APR to Effective Interest Rate Calculator—to help you make more informed financial decisions.

Understanding APR and Effective Interest Rate

- APR:

- The APR represents the nominal interest rate charged on a loan or credit card.

- It includes both the interest rate and any additional fees or costs associated with borrowing.

- Lenders are required to disclose the APR to borrowers.

- However, the APR does not account for the frequency of compounding.

- Effective Interest Rate:

- Also known as the Effective Annual Rate (EAR) or Annual Equivalent Rate (AER), it considers the impact of compounding.

- The EAR reflects the true cost of borrowing, including how often interest is compounded.

- It provides a more accurate measure of the interest rate you’ll pay over a year.

Calculating the Effective Interest Rate from APR

To calculate the Effective Interest Rate from APR, you need to know the APR and the number of compounding periods per year. The formula for EIR is:

EIR = (1 + r / m)m − 1

where:

- EIR — Effective interest rate;

- r — Annual interest rate, which is the nominal interest rate in percent, also called the stated or quoted rate; and

- m — Compounding periods, which is the number of times compounding occurs in a year. In other words, the period after which the interest will be calculated on the principal amount and then added to it (capitalized on it).

Why Use an EIR Calculator?

Manually calculating the EIR can be time-consuming and prone to errors, especially for those who are not comfortable with mathematical formulas. An online EIR calculator simplifies the process:

- Input the APR: Enter the annual percentage rate as a percentage.

- Select the Compounding Period: Choose how often the interest compounds (monthly, quarterly, etc.).

- Calculate: Click the calculate button to get the Effective Interest Rate instantly.

Using an Online Calculator

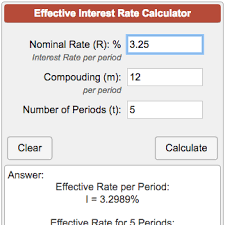

If you prefer a quick solution, you can use an online Effective Interest Rate Calculator. Simply input the nominal rate, compounding frequency, and the number of periods to get the accurate effective interest rate .

Remember that understanding the effective interest rate helps you make informed financial decisions. Whether you’re comparing loan offers or evaluating investment opportunities, knowing the true cost of borrowing is essential!

Conclusion

While APR provides a starting point, the Effective Interest Rate offers a more accurate representation of the true cost of borrowing. By using an APR to EIR calculator, you can gain a deeper understanding of the financial implications of your loan decisions and make informed choices that save you money in the long run.