A term insurance plan is a simple and pure-risk form of life insurance provided as a safety shield to the policyholder’s family or beneficiaries. It provides financial protection when death even happens, and the beneficiary will receive a large amount of term life insurance coverage at affordable monthly premiums.

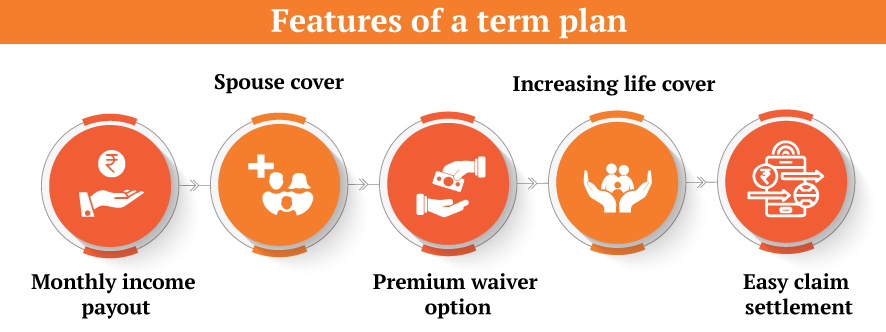

Inclusive Features

Several features make the term insurance plan essential for every individual or family, let’s take a look:

- Low entry age: Term insurance plans have a minimum entry age of 18 years only, allowing young adults to secure their loved ones early on.

- Long-Term Protection: The term plan offers long policy tenures of up to 40 years that allow you to protect your family members for a long time.

- Easy Premiums options: Term insurance only provides a death benefit and does not include an investment component, as it generally comes with lower premiums than other life insurance types.

- Adjustable Covers: A term insurance plan is flexible and allows you to increase the sum assured if you have opted for the life-stage option at the time of buying the plan.

- Liability Protection: The sum assured of a term insurance plan can be used to ensure your family’s financial security and protect them from debt liabilities like loan repayment.

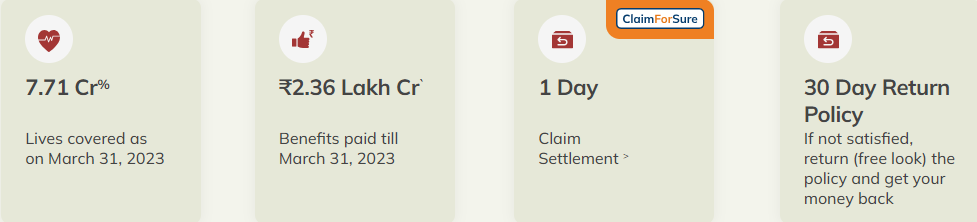

Why choose ICICI Prudential Life?

Steps to Buy Term Insurance

- Fill out the application form with the required details.

- Make payment & submit the necessary documents.

- Complete the full medical check-up and wait for verification.

- The policy is issued; get the term insurance plan document.

Calculate with a quick and clear way to get the best insurance plan to cover. A calculator, like the HLV, provides an easy-to-use method of estimating how much cover you might need. Here is a basic rule to determine your Human life value:

| Age | Base policy Premium (Life Cover ₹ 1 crore) | With Critical Illness benefit (₹ 10 lakh) | With Accidental Death Benefit (₹ 50 lakh) | With Critical Illness (₹ 10 lakh) + Accidental Death Benefit (₹ 50 lakh) |

| 25 years | ₹ 597 | ₹ 723 | ₹ 884 | ₹ 1,010 |

| 35 years | ₹ 858 | ₹ 1,186 | ₹ 1,145 | ₹ 1,473 |

| 45 years | ₹ 1,969 | ₹ 2,875 | ₹ 2,256 | ₹ 3,162 |

| 55 years | ₹ 4,446 | ₹ 6,544 | ₹ 4,733 | ₹ 6,831 |

Coverage Benefits

Additional Benefits make the term insurance plan necessary, check out the special benefits provided with the policy plan:

- Affordability: Offers high coverage at a lower premium compared to other life insurance products.

- Simple and Straightforward: The purpose is to provide a death benefit, making it easy to understand without complex investment options.

- Financial Security: Provides a financial safety net for your family or dependents in case of your untimely death to cover the expenses and maintain their standard of living.

- Tax Benefits: Premiums paid towards term insurance are eligible for tax deductions under Section 80C of the Income Tax Act.

- Protection against accidental death or disability: Term insurance is crucial for protecting against the financial burdens of unpredictable accidents.

Additional add-ons

You can add riders or add-on benefits to your term insurance policy to extend the scope of your base coverage at a nominal cost. Various types of riders are available with term plans, such as:

- Critical Illness Rider

- Accidental Death Cover

- Waiver of Premium Benefit in case of a permanent disability

Considerations

Before selecting the best term insurance plan, you should consider the following factors:

- Policy Term: The policy term covers your financial responsibilities, such as mortgage payments, child education, or other long-term needs.

- Coverage Amount: The sum assured should be sufficient to meet the future financial needs of your dependents.

- Renewability and Convertibility: Just take a look to see if the policy can be renewed or converted to another type of policy at the end of the term.

Overall, term insurance is a cost-effective way to provide financial protection to policyholder loved ones, focusing on the risk of death during the policy term.

Frequently Asked Questions

Who is eligible for term insurance?

The minimum age limit for buying a term insurance plan is between 18 and 65 years old.

What Factors Affect the Premium of a Term Insurance Policy?

The premium is influenced by factors such as age, health, lifestyle, the sum assured, and policy term.

Can policyholders renew a term insurance policy after the term ends?

Yes, many term insurance plans offer a renewal option, but the new premium may increase upon renewal as it will be based on your age.

What happens if the policyholder stops paying the premiums?

If you stop paying premiums, the policy will lapse, and you will lose the coverage.

Are the payouts from term insurance taxable?

In most cases, the death benefit received by the beneficiaries is tax-free.