Short-Term vs Long-Term Interest Rates: Short-term interest rates (e.g., 3-month Treasury) typically have lower yields and reflect current economic conditions. In contrast, long-term rates (e.g., 10-year Treasury) offer higher yields but carry higher risk due to their longer maturity.

Interest rates are a crucial factor in financial planning, affecting everything from mortgage payments to investment returns. Understanding the difference between short-term and long-term interest rates is essential for making informed financial decisions.

What are Interest Rates?

Interest rates represent the cost of borrowing money or the return on investment for lending capital. They play a crucial role in the economy and financial markets.

Short-Term Interest Rates

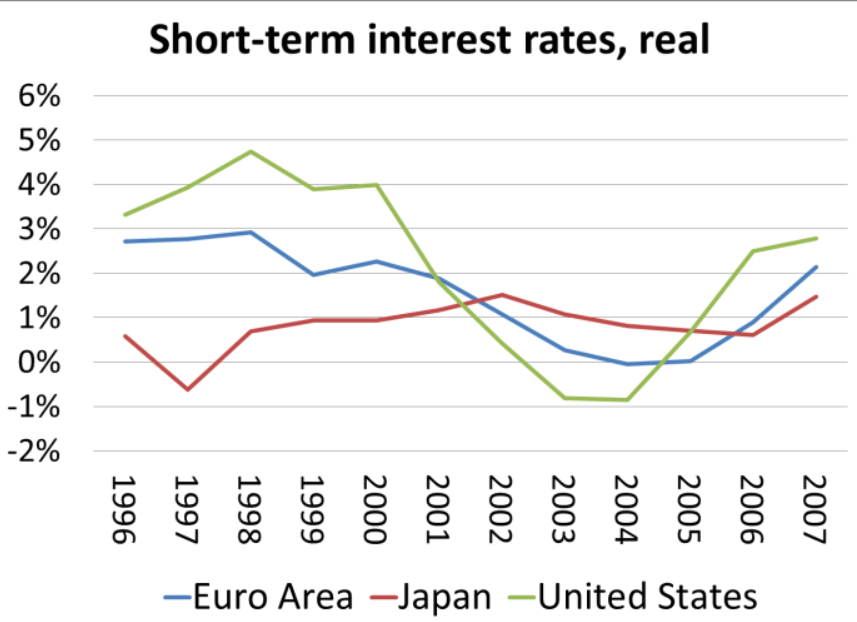

Short-term interest rates refer to the cost of borrowing or lending money for a period typically ranging from overnight to one year. Central banks, such as the Federal Reserve in the U.S., use short-term interest rates to control monetary policy and influence economic activity. Short-term rates are highly sensitive to changes in economic conditions, inflation expectations, and central bank policies. The chart below illustrates the fluctuations in short-term interest rates over time, reflecting the responsiveness of these rates to economic indicators and policy decisions.

Long-Term Interest Rates

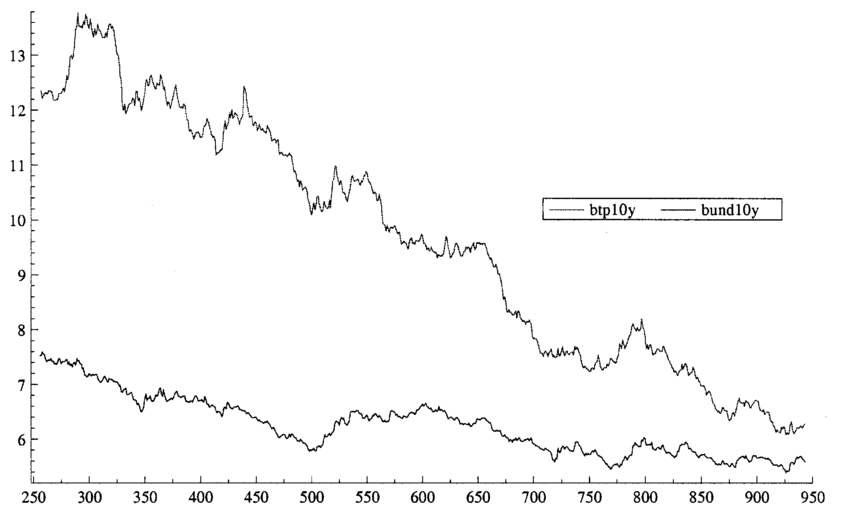

Long-term interest rates, on the other hand, represent the cost of borrowing or lending money for an extended period, usually ranging from 5 to 30 years. These rates are influenced by factors such as inflation expectations, economic growth prospects, and market sentiment. Investors often use long-term interest rates as a gauge of future economic conditions and inflation trends. The chart below depicts the historical movements of long-term interest rates, highlighting the impact of macroeconomic factors and market dynamics on these rates.

Short-Term vs Long-Term Interest Rates Chart

| Aspect | Short-Term Rates | Long-Term Rates |

|---|---|---|

| Maturity | Short-term (usually less than 1 year) | Long-term (typically 10 years) |

| Risk | Lower risk due to shorter maturity | Higher risk due to longer maturity |

| Yield | Lower yield | Higher yield |

| Market Expectations | Reflects current economic conditions | Influenced by inflation, growth, and risk |

| Impact on Economy | Immediate impact on borrowing costs | Long-term impact on investment and growth |

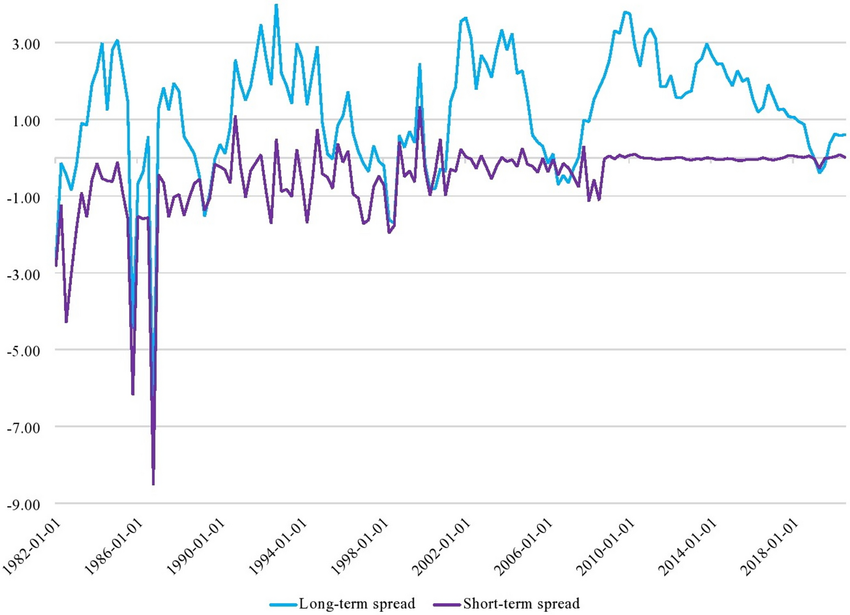

The Yield Curve

The yield curve is a graphical representation of the relationship between the interest rates (yields) of various U.S. Treasury fixed-income securities and their respective maturities. It provides valuable insights into the market’s expectations for future economic conditions.

Key Components of the Yield Curve

- Short-Term Rates: These rates reflect the yield on short-term government debt, typically with a maturity of three months. They are influenced by the Federal Reserve’s monetary policy decisions.

- Long-Term Rates: These rates represent yields on longer-term government debt, such as 10-year Treasury notes and 20-year Treasury bonds. Investors demand more compensation for holding these bonds over extended periods due to increased inflation risk and other uncertainties.

Inverted Yield Curve

An inverted yield curve occurs when short-term interest rates are higher than long-term rates. Historically, this inversion has often preceded economic recessions.

Implications for Financial Decisions

- Borrowing: Short-term rates impact variable-rate loans and mortgages, so understanding these rates is crucial when considering debt. Long-term rates influence fixed-rate loans and bonds, affecting investment decisions.

- Investing: Short-term interest rates impact returns on short-term investments like savings accounts. Long-term rates affect returns on bonds and other long-term investments.

- Central Bank Policy: Monitoring the relationship between short-term and long-term interest rates provides insights into the central bank’s monetary policy stance and its implications for the economy.

Conclusion

Understanding the difference between short-term and long-term interest rates is essential for making informed financial decisions. By following the relationship between these rates through a chart, investors and borrowers can assess economic trends and adjust their strategies accordingly. Monitoring central bank policy and economic forecasts can help individuals better navigate the complexities of the financial markets and position themselves for success.